Invoice Factoring vs. Invoice Financing: Which Option is Right for You

If you are a small business owner overwhelmed with a growing stack of outstanding accounts receivable, you are not alone. According to a report by New Sage, 13% of small and medium-sized business’ invoices are paid late. As a result, 30% of these businesses experience – or expect to experience – a direct negative impact.

Late payments can hinder everyday operations, make it difficult to cover payroll, deplete cash reserves and prevent you from moving forward with important business opportunities.

For a growing number of companies, alternative financing tools like invoice factoring and invoice financing are an ideal option. While they differ in several key ways, both provide possible solutions to managing insufficient cash flow. The main differences between the two boils down to the structure of the financing and the approach to collections.

If you are wondering which of these options is right for you, consider the following information on the similarities and differences our team of financial experts has put together to help you decide.

What is Invoice Financing?

Invoice financing, also known as invoice discounting, involves borrowing money against your outstanding accounts receivables. The lender you choose funds a portion of your unpaid invoices up front – typically 70% to 85% – in the form of a line of credit, which you can draw from at any time. The amount of your loan is ultimately determined by the value of your invoices. Essentially, your business is using its unpaid invoices as collateral to secure financing. In this arrangement, the responsibility of collecting payment from customers falls on your shoulders.

What is Invoice Factoring?

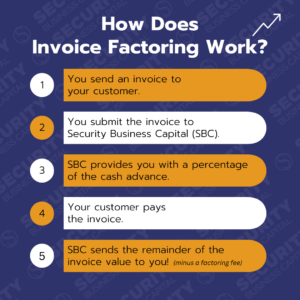

With invoice factoring, your business is selling its accounts receivables at a discount to a factoring company (“factor”). Since the factor is actually purchasing those invoices, it is a financial transaction – not a loan. Your business is simply securing money it has already earned and is waiting to be paid.

With invoice factoring, your business is selling its accounts receivables at a discount to a factoring company (“factor”). Since the factor is actually purchasing those invoices, it is a financial transaction – not a loan. Your business is simply securing money it has already earned and is waiting to be paid.

The factor then quickly advances up to 95% of an invoice’s value, known as the “advance rate.” The factoring company then assumes responsibility for collecting payment from your customers. Once your customer has paid the invoice, the factor will then give you the remaining amount, minus a small factoring fee.

What are the Advantages of Using Invoice Factoring and Financing

One of the top reasons businesses today are choosing these alternative financing options, like invoice factoring, is the speed of funding. You can bypass the paperwork, requirements and headache of traditional application processes and have cash in your business’ bank account in as little as 24 hours. Because these lenders focus on creating cash solutions that are tailored to meet the unique needs of specific business types and industries, you will also likely find this type of financing more valuable than traditional options. The fact that these lenders are more concerned with the creditworthiness of your customers can also make these cash solutions easier to secure than others.

Invoice financing best suits businesses that need money quickly and feel confident they can collect on the outstanding invoices in a timely manner. If your customers pay what they owe on time, or even early, it might prove to be an affordable option, since you only pay fees as long as the invoice is outstanding. While invoice financing is primarily a short-term solution, invoice factoring can meet your short-term needs and preserve the long-term financial health of your business. As your business grows and takes on new orders, the amount of debt-free funding available also increases.

Another benefit of invoice factoring, in particular, is the limited risk to your business of not collecting payments. Since the factoring company continually credits and qualifies your customers and takes over the task of collecting your receivables for you, it helps alleviate that back office task and help mitigate the risk of non payment.

With less of your own resources tied up, you can focus more time and attention on growing your business. If your company deals with numerous late-paying customers or unpaid invoices, invoice factoring is a great way to alleviate cash flow problems without taking on new debt.

What are the Disadvantages of Using Invoice Factoring and Financing

At first glance, invoice financing might seem like a straightforward and fast way to secure capital, but it can be expensive and risky. Fees are dependent on when your customers pay their invoice, there is the ever-present risk that they may not and, depending on the lender, you may incur a draw fee each time you use the line of credit. In addition, the interest rate depends on your balance. All of this can make it hard to determine the total cost upfront. Because the final fees are based on how long it takes your customer to pay, the ultimate cost will vary.

In some cases, invoice factoring is labeled as being less flexible of the two options because you do not have as much say in which invoices are factored and when. In reality, the key is to find a reputable and reliable invoice factoring company that not only helps you with collections and back-office tasks, but also allows you to have complete control of your invoices. With Security Business Capital, for example, you maintain the ability to choose which credit approved customers you wish to factor, as well as which invoices from those customers.

According to the same New Sage study, more than 30% of small and medium-sized businesses say protecting the client relationship is the top barrier in chasing late payments. With invoice financing, your customers’ invoices are handled as usual (by your business). On the other hand, with invoice factoring, the factor handles the collections process. Many business owners worry that this will affect their relationship with their customers. Fortunately, most factoring companies today prioritize professional and courteous communication that can actually strengthen relationships with your customers.

Security Business Capital Invoice Factoring Services

Based in Midland, Texas, Security Business Capital is a premier invoice factoring company with years of experience. Our team of experts specialize in helping businesses secure the funds they need to operate smoothly, manage the unknown and grow their business. Oil and gas, staffing, manufacturing, distribution, transportation, and business services are just a few of the industries that regularly use our solutions to generate cash on hand.

For further questions about invoice factoring or how our services work, contact us today for a free quote and/or consultation.